People often call our Customer Support Centre to ask about joint ownership and if they can confirm whether they own their property as a ‘joint tenant’ or ‘tenant in common’ from looking at their copy of their register. Our Customer Support Centre staff are unable to tell you whether you are a joint tenant or tenant in common as it is not always definitely stated in our documents, but there are a few places you can check to try and find out.

There are a variety of documents relating to property ownership which may hold some information on the type of joint ownership you have. HM Land Registry often has copies of some of these, but not all. Before you bought your property, your solicitor or conveyancer should have explained the options to you and asked you to confirm what type of joint ownership you wanted. We always recommend you contact a solicitor or conveyancer to check the type of joint ownership you have if you’re unsure.

What do the terms ‘joint tenant’ and ‘tenant in common’ mean?

If you buy, inherit or become a trustee of a property with someone else, you must decide how you want to ‘hold’ the property together. There are two ways you can become a joint owner of property under UK law: as either ‘joint tenants’ or ‘tenants in common’.

The type of ownership you choose affects what you can do with the property if your relationship with a joint owner breaks down, or if one owner dies. Your conveyancer will discuss this with you and include your choice when they register the property with us.

Joint tenants

As joint tenants (sometimes called ‘beneficial joint tenants’):

- you have equal rights to the whole property – neither one of you has a specific “share” in the property

- the property automatically goes to the other owner(s) if you die

- you cannot pass on your ownership of the property in your will

- it is much more difficult to sell the property without the agreement of all joint tenants

Tenants in common

As tenants in common:

- each of you will own a specified share in the property, which may or may not be an equal share (HM Land Registry does not always hold information on the specific shares each owner holds)

- the property does not automatically go to the other owner(s) if you die

- you can pass on your share of the property in your will

Documents that may hold information on your joint ownership

If you are looking for information on the type of joint ownership you have, this information may be held in the following documents.

| Sometimes held by HM Land Registry | Copies not usually held by HM Land Registry – ask your conveyancer about these documents |

| A property transfer

|

A 'trust deed', which is sometimes used to state each owner’s share in a property when they are tenants in common, particularly where joint owners are not related and pay different amounts of money for the property |

| A property lease | A will under which the property is inherited |

| A deed of gift | |

Application forms sent to us when we registered the ownership, for example:

|

|

| Form RX1 and form SEV – both used to enter a restriction in the register |

We do not usually hold copies of the documents in the right-hand column, so you should ask your conveyancer about these documents.

How HM Land Registry records joint ownership

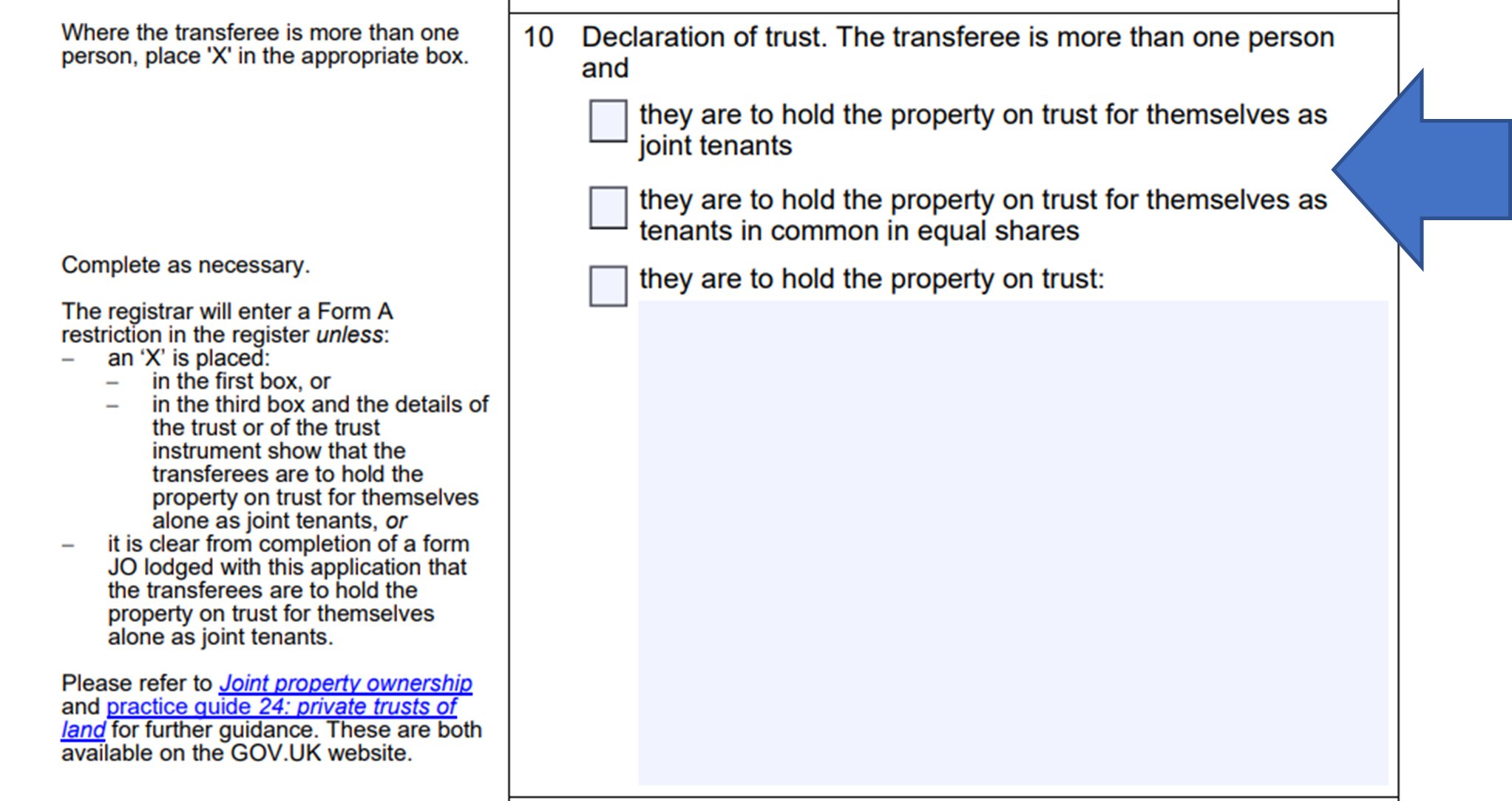

When we receive your documents from your conveyancer, we will check panel 10 of your Transfer (TR1) form to check whether you’ve chosen to be joint tenants or tenants in common. Therefore, it’s worth double-checking this panel when your conveyancer asks you to sign the form.

If you’ve chosen to hold the property as tenants in common, we’ll register a ‘Form A restriction’, which you will see in your title register. You will not see the words ‘tenants in common’ in your register, so here’s what to look for to see if you have this restriction:

“No disposition by a sole proprietor of the registered estate (except a trust corporation) under which capital money arises is to be registered unless authorised by an order of the court.”

If you choose to be joint tenants, no Form A restriction is added to your register.

- If you don’t select either joint tenants or tenants in common on this form, or it isn’t clear to us which you have decided on, we must enter a Form A restriction by default. This is one reason why seeing the restriction in your title register doesn’t necessarily mean you’re tenants in common, and why it’s a good idea to check panel 10 before signing your TR1 as we have described above. Also, there may be other reasons why a Form A restriction is entered on the register.

Download a copy of your title register. If you’ve got your title register see our guidance on how to read it.

How to change the ownership

Sometimes, over the years, circumstances change and you might want to alter the way you hold your property as a result.

You can find more information on how to change from joint tenants to tenants in common, or vice versa, on GOV.UK.

We strongly recommend consulting a legal adviser and a financial adviser before making any changes, to consider the possible impact of any decisions you make – which might affect you either now or at a later date.

14 comments

Comment by Jeffrey Shaw, solicitor, Nether Edge Law posted on

This does not explain sufficiently the position that arises following the death of one of the two (or of the final two) joint proprietors.

The survivor becomes the sole legal owner no matter what.

If they are BJT, the survivor also becomes the sole beneficial owner.

If they are TIC, the form A entry restricts future dealings unless a second trustee is appointed.

Under "How HM Land Registry records joint ownership", also show a form JO. If this is used, panel 10 of TR1 need not be.

Comment by Gavin Curry posted on

Hello Jeffrey. Many thanks for your comments. The blog is aimed at members of the public and focuses on the questions they ask our customer support colleagues. We are considering another blog about dealing with property after a death. We have referenced form JO in the blog, however it is a voluntary form and the TR1 example is by far the most common way that buyers/conveyancers confirm such matters for us.

Comment by Wil Bailey posted on

Thank you for the above, Ms Huitson. We would welcome 'another blog about dealing with property after a death' so that we could keep a copy with our Mirror Wills, and for the guidance of trustees.

Comment by Gavin Curry posted on

Hello Wil. Thank you for your comment and suggestion. We are considering another blog about dealing with property after a death.

Comment by Paul Handford posted on

I don't understand why you do not simply note in the proprietorship register whether the purchasers are joint tenants or tenants in common at the date of transfer when they have clearly expressed which it is on the transfer form.

Likewise if they file to sever the tenancy or become joint tenants again. It is not as if the restrictions are an afterthought and this would be a terrible drain on resources.

Comment by Gavin Curry posted on

Hello Paul. Effectively we do reflect whether purchasers are joint tenants or tenants in common at the date of transfer, by the entry (or absence) of a Form A restriction in the register, as set out in the article. The register records the ownership of the legal estate, not the beneficial interests, and the registrar is not affected with notice of a trust (section 78 of the Land Registration Act 2002). Generally, therefore, we would not specifically refer to a trust in the register or, indeed, to tenants in common. It may be also that a trust does exist, but HM Land Registry is unaware of it as no application has been made to protect that trust by entering a restriction. Similarly, proprietors who are tenants in common might have made an agreement to become joint tenants, but not made the necessary application to HM Land Registry to reflect this in the register. For full information about private trust of land and what can and can’t be reflected in the register please refer to practice guide 24. https://www.gov.uk/government/publications/private-trusts-of-land

Comment by Jeff evans posted on

Can a joint owner of a parcel of land , sell his half share without the other joint owners permission?

Comment by Gavin Curry posted on

Hello Jeff. Yes, but to then transfer the legal ownership from both names to the new joint names would require the other owner to be involved.

Comment by Karen posted on

If you want to transfer land from deceased parents to three siblings - but there are unequal shares due to a deed of variation to the will - you can fill in a JO form to address this - however what if the sibling whose share is less than the other two siblings will not sign the relevant forms. The two other siblings have letters of administration and want to ensure the land is transferred to the 3 siblings but address they are tenants in common and set out the unequal shares.

Comment by Gavin Curry posted on

Hello Karen. The siblings need to seek legal advice about their arrangements. We can only give advice about our processes.

Comment by Karen posted on

Thanks for the reply What forms do we need to fill in for the land registry?

Comment by Gavin Curry posted on

Hello Karen. You'll find that set out in this guidance (How to update property records when someone has died): https://customerhelp.landregistry.gov.uk/guide-external-start/?guideid=e0861516-8882-eb11-a812-000d3ad48f95

Comment by Tricia posted on

I am trying to find out whether my husband and I are Tenants in Common or Joint Owners and finding it very confusing. I am looking at title deeds for 2 properties we own and neither say TIC or JO. It would be so much easier if they did!

Please advise.

Comment by Gavin Curry posted on

Hello Tricia. The blog suggests various ways of finding out. Please see 'Documents that may hold information on your joint ownership' and 'How HM Land Registry records joint ownership'.