We receive a lot of applications that refer to discounts and incentives, but there can be confusion over which is which. This is important because it affects the entry we will make in the Land Register and our house price data, so if an application is incorrect or unclear, we will have to raise a requisition to request more information.

Last year (1 April 2023 to 31 March 2024), we sent 2,035 requisitions over discounts and incentives, 806 of these in the first three months of 2024 alone, so I’d like to help you avoid such delays by explaining exactly what we are looking for. If, at the end of this explanation, you’d like more information, you can find it in our practice guide 7: entry of price paid or value stated data in the register.

What is a discount?

HM Land Registry considers a discount to be a cash sum deducted from the purchase price.

A discount may also be referred to as:

- an equity discount/gifted equity towards deposit

- a gifted deposit

- a gifted equity

- cashback

In most cases, if the money paid by the buyer to the seller is less than the purchase price of the property, we regard the difference between these two sums as a discount.

It is our practice to deduct the discount from the purchase price as this represents a true reflection of the price paid for the property and enter the net (lower) sum.

What is an incentive?

HM Land Registry considers an incentive to be something the seller offers, which does not relate to the purchase price, for example:

- help with moving costs

- the seller paying legal costs, stamp duty or land transaction tax

- providing carpeting or white goods

- an upgrade to the kitchen package or bathroom fittings

We also consider assistance under a Homebuy/Help to Buy scheme (that is, money loaned to a purchaser through the schemes) to be an incentive and not a discount as this must be repaid at some point in the future.

It is our practice here to enter the gross price and take no action in respect of the incentives.

Main issues

The Council of Mortgage Lenders requires conveyancers to tell lenders when a discount or incentive is given as part of a property’s purchase price. This helps lenders decide whether or not to make an advance and, if so, the amount of money to lend.

The problem is that ‘incentive’ can mean something different depending on who is using the term. While a buyer may perceive an incentive as a form of discount on the property, HM Land Registry does not, and we register the price paid accordingly. For us, a discount is deducted from the price paid, but we take no action in respect of any incentives.

What you need to do

In the TP1 form, enter the correct price paid, net of any discount (that is, the actual sum the buyer has paid to the seller) in the consideration panel. You can make a reference to a discount or incentive in the additional provisions panel (panel 11) of a transfer.

What this means in practice

Let’s look at some examples.

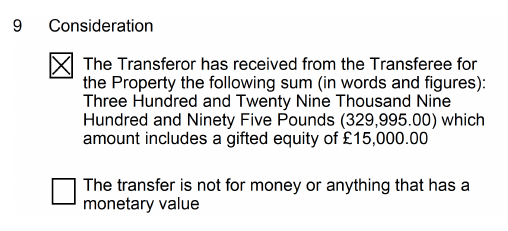

1. A correctly worded consideration panel

In this case, you have told us that £329,995 is the gross price and we will deduct the discount of £15,000. We will enter £314,995 as the price paid in the register.

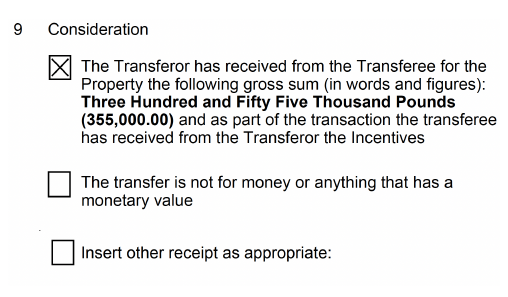

2. When there is additional wording in the body of the transfer

Then later in the deed:

In this case you have told us that £355,000 is the gross price and we will deduct the discount of £17,750. We will enter the net price of £337,250 as the price paid in the register. We will take no further action in respect of the kitchen and flooring upgrades, which we consider to be incentives.

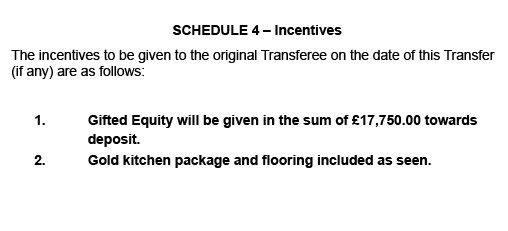

3. Ambiguous wording, which would require a requisition to determine the price paid

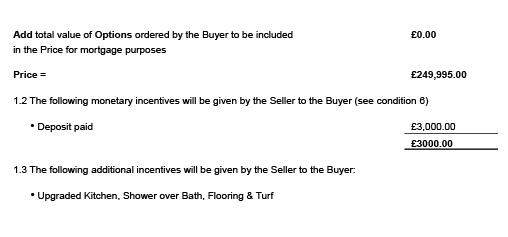

No contract for sale was lodged so we requisitioned for a copy. Here is what we received:

In this case you have told us that £249,995 is the gross price and we will deduct the discount of £3,000. We will enter the net price of £246,995 as the price paid in the register.

No action taken in respect of the upgrades to the kitchen, and so on.

4. Finally, another example using different wording

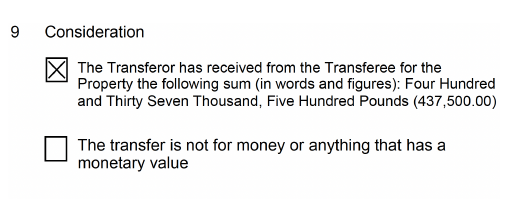

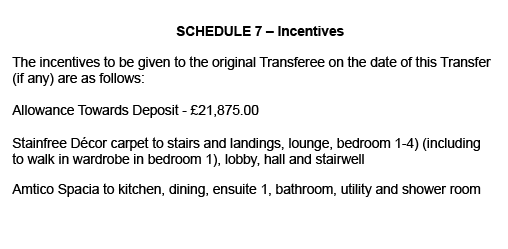

Then, in the body of the transfer:

In this case you have told us that £437,500 is the gross price and we will deduct the discount of £21,875. We will enter the net price of £415,625 as the price paid in the register. We will take no action in respect of the flooring upgrades, which we consider to be incentives.

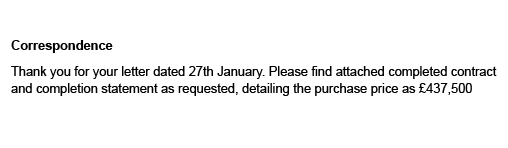

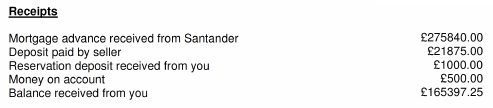

On completion we received correspondence from the acting conveyancers suggesting that the price paid was incorrect. We sent a requisition for clarification and we got this letter back from the conveyancer:

The contract for sale showed:

This highlights the confusion between a discount and an incentive. Practice guide 7 sets out what we class as a discount and we will apply this to all applications.

Being clear on the distinction between a discount and an incentive leads to less correspondence between HM Land Registry and conveyancers, protects the integrity of our register and ensures the accuracy of published price paid data.

5 comments

Comment by Jeanne James posted on

This article is very informative and comprehensive. It has clarified this subject for me. Thank you.

Comment by CAROLINE WOFINDEN posted on

This is very welcome clarification. Unfortunately, many lenders will still insist on the gross price being shown in the documentation. It would be great if Land Registry could liaise with UK Finance to try to get consistency of approach between lender and Land Registry.

Comment by Gavin Curry posted on

Thanks for your comment. While we don't have any current plans to align the approaches, we are in regular conversation with both UK Finance and the major lenders. If there is any change in this area we will update our guidance.

Comment by Neil McKenzie posted on

Whilst the article provides useful guidance for conveyancers. It is questionable if the approach to discounts and incentives provides an accurate figure of the net price. For example, if the developer pays £20,000 as a gifted deposit this is discounted from the price paid, but if the developers instead pays £20,000 to cover stamp duty it is not discounted. In both scenarios the total costs are the same to the purchaser and developer. The stated approach could therefore see two identical properties on the same development listed with a significant price difference purely because the transactions were structured differently.

Comment by Adam H HMLR posted on

Your comment highlights the often confusing difference between discounts and incentives with regard to price paid data. For our purposes, a gifted deposit and stamp duty land tax are two different things: the £20,000 deposit was part of the price, but has not been paid, so to include that discounted amount in the price paid would be incorrect and not in accordance with rule 8(2)(c) of the Land Registration Rules 2003. Paying the Stamp Duty Land Tax or Land Transaction Tax is another form of inducement to help facilitate the purchase, however, it doesn’t involve a sum being deducted from the sale price. We do understand that as far as the developer is concerned, their balance at the end of the sale would be the same.